Forex trading is the act of buying and selling currencies in the global market. Many people are attracted to forex trading because of the potential to earn money from the fluctuations of exchange rates. But is it possible to make 100 dollars a day with forex?

The answer is not simple. Forex trading involves a lot of risk, uncertainty and volatility. There is no guarantee that you will make a profit, let alone 100 dollars a day. Forex trading requires a lot of skill, knowledge, experience and discipline. You also need to have a reliable broker, a good trading platform, a sound strategy and a realistic mindset.

Some factors that can affect your forex trading performance are:

- The size of your trading account. The larger your account, the more you can trade and the more you can potentially earn. However, you also need to consider the risk-reward ratio and the leverage involved. Trading with a small account can limit your opportunities, but trading with a large account can expose you to bigger losses.

- The currency pairs you trade. Different currency pairs have different characteristics, such as liquidity, volatility, spread and correlation. Some pairs are more suitable for beginners, while others are more challenging and require more analysis. You also need to be aware of the economic and political events that can affect the currency pairs you trade.

- The time frame you trade. Forex trading is available 24 hours a day, five days a week. However, not all hours are equally active and profitable. You need to find the best time frame for your trading style, strategy and goals. Some traders prefer to trade in short-term time frames, such as minutes or hours, while others prefer to trade in long-term time frames, such as days or weeks.

- The strategy you use. There are many different strategies for forex trading, such as technical analysis, fundamental analysis, trend following, scalping, swing trading, breakout trading and more. You need to find a strategy that suits your personality, skills and objectives. You also need to test your strategy on a demo account before using it on a live account.

- The risk management you apply. Risk management is crucial for forex trading success. You need to have a clear plan for how much you are willing to risk per trade, how much you are willing to lose per day or week, and how you will exit your trades when they reach your target or stop loss levels. You also need to use appropriate tools such as stop losses, trailing stops and take profits to protect your capital and lock in your profits.

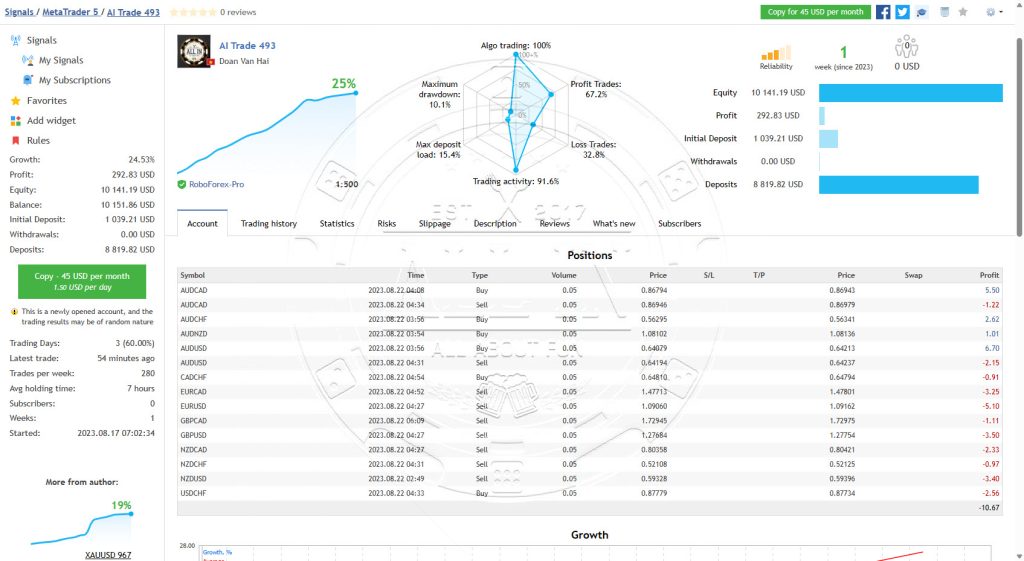

- Trade with Kintech. Review, rate and copy-trade Kintech signals: MT5 Traders rating (roboforex.com)

So, is it possible to make 100 dollars a day with forex? The answer is yes, but it is not easy. It depends on many factors and requires a lot of effort, patience and discipline. You also need to be realistic and accept that there will be losses along the way. Forex trading is not a get-rich-quick scheme, but a long-term journey that can be rewarding if done properly.