Have you ever wondered how you can turn $100 into $1,000? It may sound like a daunting task, but with the right strategies and a little bit of patience, it’s definitely possible. In this article, we will explore 21 proven methods that can help you grow your money and turn that initial $100 investment into a substantial $1,000. Whether you’re interested in investing, starting a side hustle, or focusing on personal development, we’ve got you covered. Let’s dive in!

1. Invest in Rental Properties with Arrived

Investing in real estate is a tried and true method for growing your money over time. If you want to make the most out of your $100, consider investing in rental properties through platforms like Arrived. By putting your money into real estate, you can benefit from rental income, property appreciation, and tax advantages. While this method may require a larger initial investment, it has the potential to generate significant returns in the long run.

2. Invest in Index Funds

If you’re looking for a more hands-off approach to investing, consider putting your $100 into index funds. Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500. By investing in index funds, you can gain exposure to a diversified portfolio of stocks, reducing the risk associated with individual stock picking. Over time, as the market grows, your investment has the potential to grow as well, turning your $100 into $1,000 or more.

3. Start a Freelance Portfolio

If you’re interested in turning your $100 into $1,000 in a relatively short amount of time, consider starting a freelance portfolio. By leveraging your skills and expertise, you can offer your services to clients on platforms like Upwork or Fiverr. Create a compelling portfolio that showcases your abilities and start pitching potential clients. With determination and a bit of luck, landing a high-paying freelance job can help you achieve your financial goal quickly.

4. Explore High-Yield Savings Accounts

While not the most exciting option, putting your $100 into a high-yield savings account can be a safe and reliable way to grow your money. Look for reputable online banks that offer competitive interest rates on their savings accounts. Over time, your $100 investment will accrue interest, helping it inch closer to that $1,000 mark. Remember to compare different banks and their interest rates to maximize your earnings.

5. Invest in Peer-to-Peer Lending

Peer-to-peer lending platforms, such as Prosper or LendingClub, connect borrowers directly with individual investors like yourself. By lending out your $100 to borrowers, you can earn interest on your investment. However, keep in mind that peer-to-peer lending carries risks, such as the potential for defaults. Conduct thorough research, diversify your investments, and choose reputable platforms to minimize your risk exposure.

6. Start a Side Hustle

Turning $100 into $1,000 can also be achieved by starting a side hustle. Identify your skills, passions, and interests, and find a way to monetize them. Whether it’s selling handmade crafts on Etsy, offering tutoring services, or providing consulting in your area of expertise, a side hustle can help you generate additional income. Dedicate your time and effort to growing your side business, and you’ll soon see your initial $100 investment multiply.

7. Invest in Dividend-Paying Stocks

Dividend-paying stocks can be an excellent way to grow your money over time. By investing in companies that distribute a portion of their earnings to shareholders, you can benefit from regular dividend payments. Reinvesting these dividends can accelerate the growth of your investment. However, remember to conduct thorough research and choose stable and reputable companies with a history of consistent dividends.

8. Explore Micro-Investing Apps

Micro-investing apps, such as Acorns or Stash, allow you to invest small amounts of money in a diversified portfolio of stocks and exchange-traded funds (ETFs). These apps often round up your everyday purchases to the nearest dollar and invest the spare change. While the individual investments may be small, they can add up over time. With consistent contributions and market growth, your $100 investment can grow into $1,000 or more.

9. Invest in Cryptocurrencies

Cryptocurrencies have gained significant popularity in recent years, and they offer an alternative investment option for those looking to grow their money. Consider allocating a portion of your $100 to reputable cryptocurrencies such as Bitcoin or Ethereum. However, be aware that cryptocurrency markets can be volatile, so it’s essential to educate yourself and invest responsibly.

10. Invest in Your Education and Skills

Investing in yourself is one of the best long-term strategies for growing your money. Consider using your $100 to enroll in online courses, workshops, or seminars that can enhance your skills or expand your knowledge. By continuously improving yourself, you increase your earning potential and open up new opportunities for financial growth.

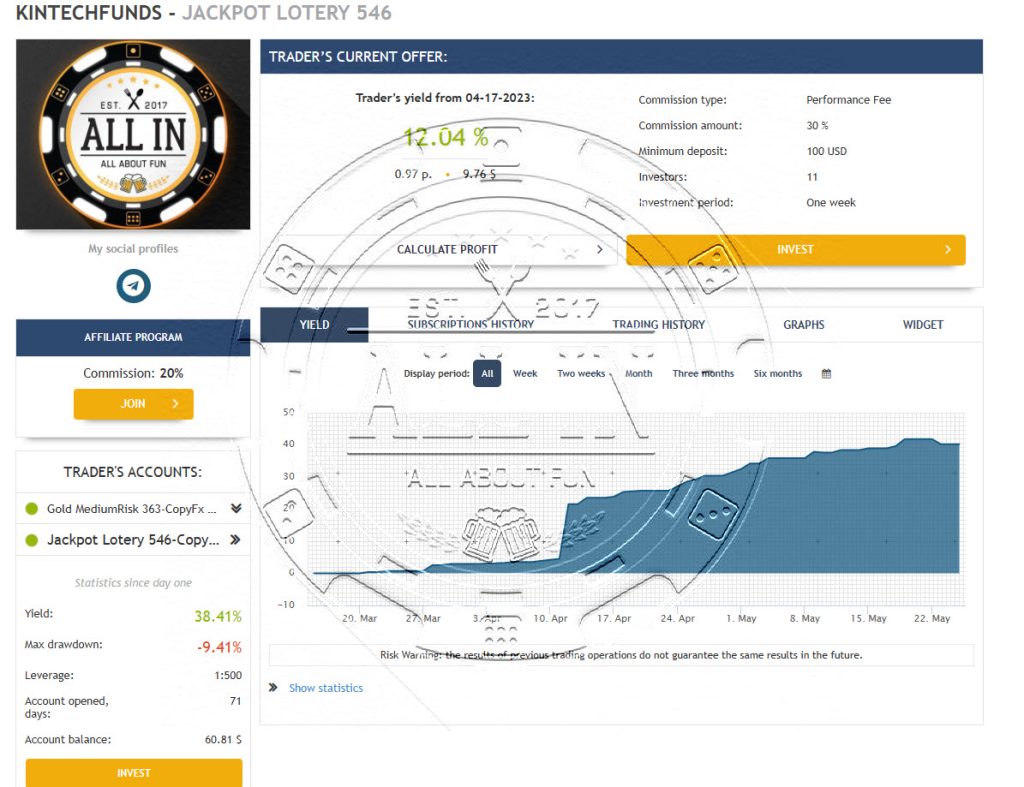

11. Invest in Kintech Asia copy-trade strategy

FAQs

Q1: Is it really possible to turn $100 into $1,000?

A1: Yes, it is possible to turn $100 into $1,000 with the right investment strategies, side hustles, or personal development efforts. While it may require time and effort, many people have successfully achieved this goal.

Q2: How long will it take to turn $100 into $1,000?

A2: The time it takes to turn $100 into $1,000 depends on the investment or side hustle chosen, market conditions, and individual efforts. It could take weeks, months, or even longer to reach the desired amount.

Q3: Are there any risks involved in investing or starting a side hustle?

A3: Yes, there are risks involved in investing and starting a side hustle. Investments can fluctuate in value, and side hustles may require time and effort before generating significant income. It’s important to conduct thorough research and manage risks effectively.

Q4: Are there any guarantees that these methods will work?

A4: There are no guarantees when it comes to investing or starting a side hustle. Success depends on various factors, including market conditions, individual efforts, and external factors. It’s crucial to approach these methods with realistic expectations and a willingness to adapt.

Q5: Can I use multiple methods together to turn $100 into $1,000?

A5: Absolutely! Combining multiple methods can diversify your income streams and increase your chances of success. Consider creating a well-rounded strategy that aligns with your goals and risk tolerance.

Remember, it’s essential to conduct thorough research and make informed decisions based on your financial situation and goals.

Conclusion

Turning $100 into $1,000 may seem challenging, but with the right strategies and a bit of determination, it’s definitely achievable. Whether you choose to invest in real estate, stocks, or yourself, it’s important to stay focused, educate yourself, and be patient. Remember, building wealth takes time, and small steps in the right direction can lead to significant results. So go ahead, choose the method that resonates with you the most, and start growing your $100 into $1,000 or more.