If you’ve ever been intrigued by the exciting world of foreign exchange trading, commonly known as Forex, you might wonder if it’s possible to start with a modest sum of $100. The good news is that trading Forex with $100 is indeed feasible, and it can be an excellent way to dip your toes into the world of currency trading. In this comprehensive guide, we will explore the steps and strategies you need to know to invest $100 in the Forex market successfully.

Understanding the Forex Market

Before diving into Forex trading, it’s crucial to have a solid understanding of the market. The Forex market is where different currencies are exchanged, and it operates globally, 24 hours a day, five days a week. Currency pairs are traded based on their exchange rates, and traders aim to profit from fluctuations in these rates. It’s important to note that Forex trading involves a degree of risk and requires careful analysis and decision-making.

Step-by-Step Guide to Trading Forex with $100

Step 1: Educate Yourself

To embark on your Forex trading journey, it’s essential to educate yourself about the market. Familiarize yourself with basic Forex concepts such as currency pairs, pip values, leverage, and risk management. There are various educational resources available online, including articles, tutorials, and online courses, which can provide valuable insights into Forex trading strategies and techniques.

Step 2: Choose a Forex Broker

Selecting a reliable Forex broker is crucial for a successful trading experience. Look for brokers that offer low minimum deposit requirements and competitive spreads. Ensure that the broker is regulated by a reputable financial authority to guarantee the safety of your funds. It’s also advisable to read reviews and compare different brokers before making your final decision.

Profit Share Bonus RoboForex – up to 60% for each deposit

Step 3: Open a Forex Trading Account

Once you’ve chosen a Forex broker, you’ll need to open a trading account. Most brokers offer different types of accounts, including those suitable for traders with smaller budgets. Opt for an account that allows you to trade with a minimum deposit of $100 or less. During the account opening process, you will need to provide some personal information and complete any required verification steps.

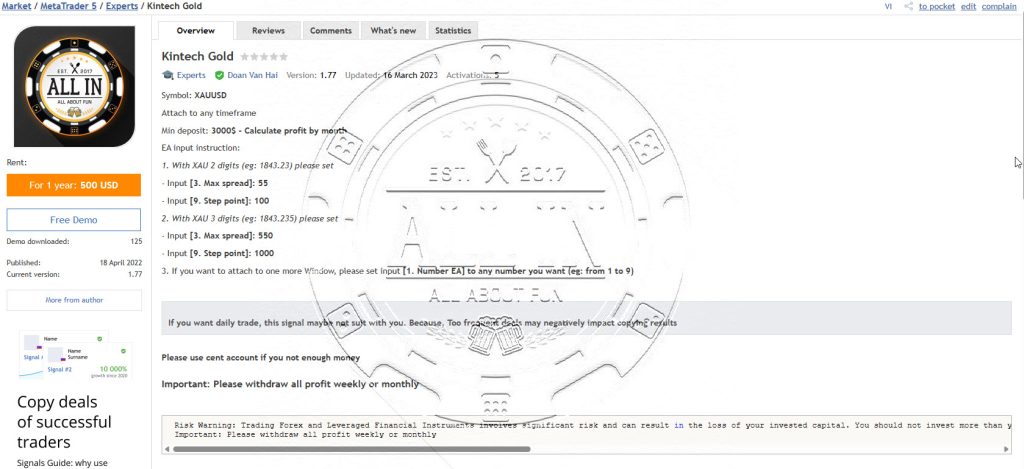

How to start ? – Kintech Asia Gold EA

Step 4: Develop a Trading Strategy

Before entering the Forex market, it’s essential to develop a trading strategy that aligns with your financial goals and risk tolerance. Determine your preferred trading style, whether it’s day trading, swing trading, or long-term investing. Consider utilizing technical analysis tools and indicators to identify potential entry and exit points for your trades. It’s also crucial to establish risk management rules to protect your capital.

Try Kintech Robot for Gold: https://www.mql5.com/en/market/product/80468

Step 5: Start Trading with a Demo Account

To gain practical experience and refine your trading skills, it’s recommended to start with a demo account provided by your chosen Forex broker. A demo account allows you to trade with virtual money, simulating real market conditions. Use this opportunity to test your trading strategy, familiarize yourself with the trading platform, and learn how to execute trades effectively.

Step 6: Fund Your Live Trading Account

Once you feel confident in your trading abilities, it’s time to fund your live trading account with your $100 investment. Most brokers offer various payment options, including bank transfers, credit/debit cards, and online payment processors. Ensure that you follow the deposit instructions provided by your broker and be mindful of any associated fees.

Step 7: Implement Risk Management Measures

As you begin trading with real money, it’s crucial to implement risk management measures to protect your investment. Determine the maximum amount you are willing to risk per trade, known as the risk percentage, and adhere to it strictly. Consider setting stop-loss orders to automatically exit trades if the market moves against you, limiting potential losses.

Step 8: Start Trading and Monitor Your Positions

With your live trading account funded and risk management measures in place, you are ready to start trading Forex. Monitor the market, analyze currency pairs, and execute trades based on your trading strategy. Keep track of your positions, review your trades regularly, and make adjustments to your strategy as needed. It’s essential to maintain discipline and avoid making impulsive decisions based on emotions.

FAQs

Q1: Can I make a profit trading Forex with $100?

Yes, it is possible to make a profit trading Forex with $100. However, it’s important to manage your expectations and understand that the potential returns will be proportional to your investment. Proper risk management, a well-defined trading strategy, and continuous learning are key factors in achieving success in Forex trading.

Q2: Is Forex trading risky?

Yes, Forex trading carries a degree of risk. The Forex market is highly volatile and subject to various economic and geopolitical factors that can impact currency exchange rates. It’s crucial to thoroughly educate yourself, develop a sound trading strategy, and implement risk management measures to minimize potential losses.

Q3: Are there any additional costs involved in Forex trading?

While some brokers offer commission-free trading, there may be other costs involved, such as spreads, overnight financing charges (swap fees), and withdrawal fees. It’s important to review the fee structure of your chosen broker and consider these costs when planning your trades.

Q4: Can I trade Forex on my mobile device?

Yes, many Forex brokers offer mobile trading platforms that allow you to trade on the go. These mobile apps provide access to real-time market data, order placement, and account management features, enabling you to monitor and trade the Forex market from your smartphone or tablet.

Q5: How long does it take to become a successful Forex trader?

Becoming a successful Forex trader requires time, practice, and continuous learning. It’s difficult to determine an exact timeframe as individual results may vary. Consistent effort, discipline, and a commitment to ongoing education are crucial in improving your trading skills and achieving long-term success.

Conclusion

Trading Forex with $100 is an accessible way for beginners to enter the exciting world of currency trading. By following the steps outlined in this guide, educating yourself, selecting a reputable broker, developing a trading strategy, and practicing with a demo account, you can embark on your Forex trading journey with confidence. Remember to approach Forex trading with patience, discipline, and a focus on continuous improvement. With diligent effort and proper risk management, you can navigate the Forex market and potentially grow your initial $100 investment.