Investing in gold has long been a popular choice for individuals seeking to diversify their investment portfolios and safeguard their wealth. In this comprehensive guide, we will explore various ways to invest in gold, from physical gold to gold ETFs, providing you with valuable insights and practical strategies to make informed investment decisions.

Understanding the Importance of Gold as an Investment

Gold has been revered as a safe-haven asset and a store of value for centuries. It is often considered a “risk diversifier” due to its historically low correlation with other assets such as stocks and bonds. This unique characteristic makes gold an attractive investment option for mitigating risk and protecting wealth during times of economic uncertainty.

Investing in Physical Gold

- Gold Bullion: One of the most common ways to invest in physical gold is through purchasing gold bullion. Gold bullion refers to investment-grade gold bars, ingots, or coins that are at least 99.5% pure. These tangible assets provide investors with direct ownership of gold and are often sold by reputable gold retailers.

- Gold Jewelry: Another way to invest in gold is by purchasing gold jewelry. While primarily considered a form of personal adornment, gold jewelry holds intrinsic value due to its gold content. However, it’s important to note that the value of gold jewelry may include additional costs such as craftsmanship and design, which can impact its investment potential.

Investing in Gold Exchange Traded Funds (ETFs)

Gold ETFs offer investors a convenient and cost-effective way to gain exposure to the price movements of gold without physically owning the metal. These investment vehicles trade on stock exchanges and track the performance of gold prices. Here are some common options for investing in gold ETFs:

- SPDR Gold Shares ETF: This popular ETF trades on various stock exchanges and provides investors with an opportunity to invest in gold. It is known for its liquidity and can be purchased through brokerages. It is worth noting that the availability of gold ETFs may vary depending on the country or region.

- Robo-Advisors: With the rise of robo-advisors, investors can now gain exposure to gold through managed portfolios. Selecting a robo-advisor that includes gold as part of its investment strategy allows individuals to benefit from professional asset allocation and diversification while having exposure to the precious metal.

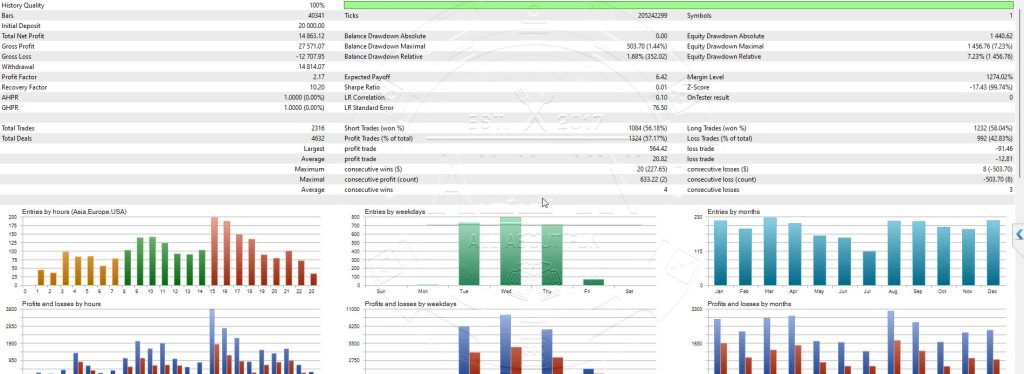

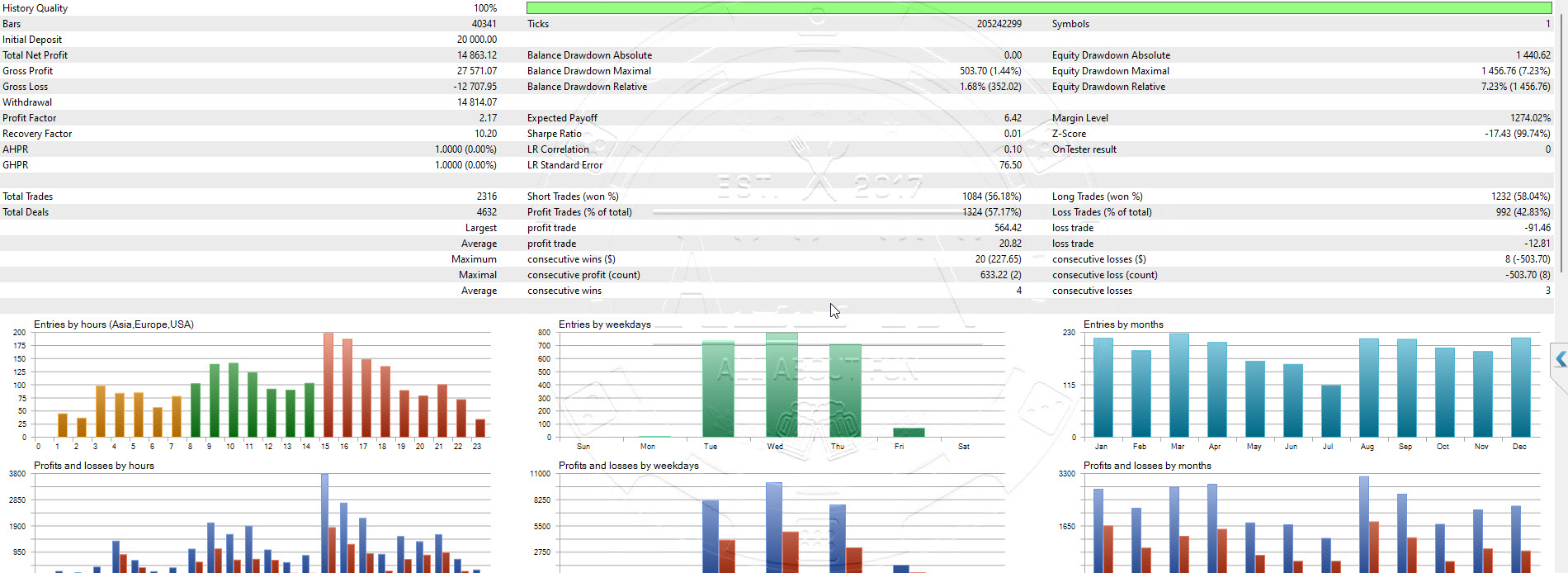

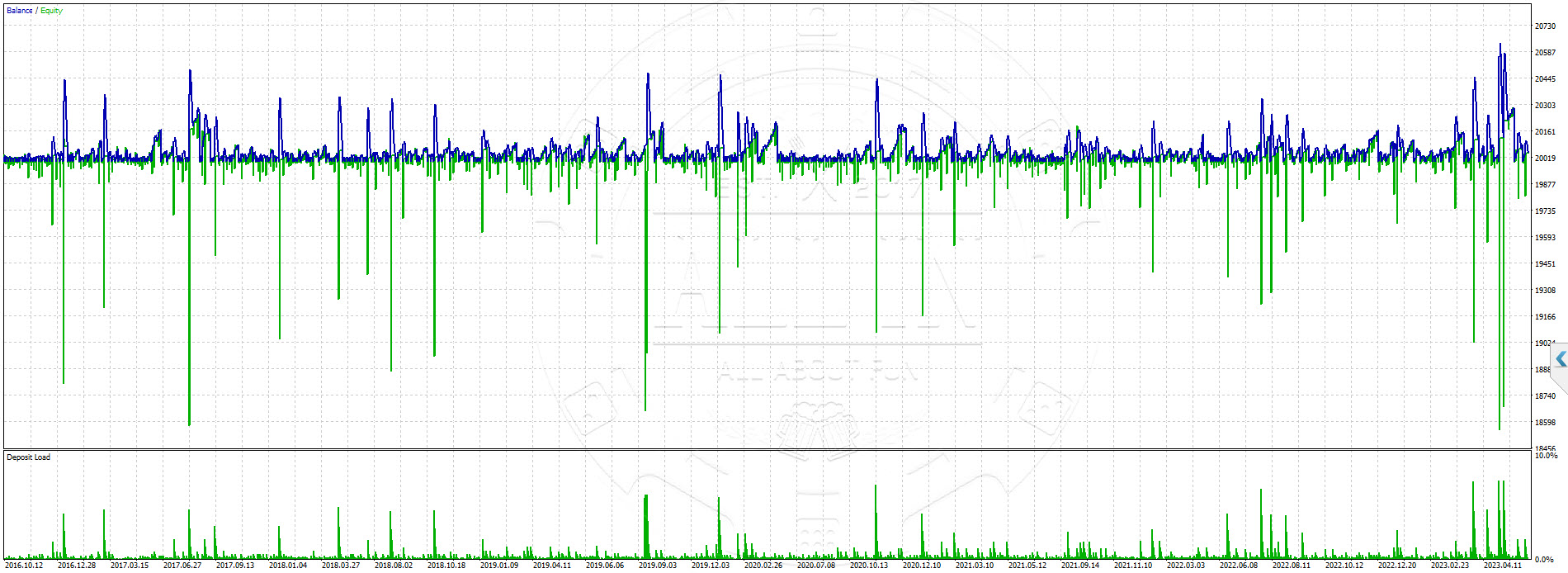

Copy-trade from Master Kintech Asia

Kintech Asia is a team of gold experts. They have created a great gold trading system that has made a lot of money for them and their clients

Factors to Consider When Investing in Gold

- Risk Tolerance: Like any investment, it is crucial to assess your risk tolerance before investing in gold. Gold prices can experience volatility, and understanding your ability to tolerate price fluctuations is essential in making sound investment decisions.

- Investment Horizon: Consider your investment horizon when investing in gold. While gold can be a long-term store of value, it is important to align your investment time frame with your financial goals and objectives.

- Research and Due Diligence: Before investing, conduct thorough research and due diligence on the various investment options available. Understand the costs, fees, liquidity, and potential risks associated with each investment avenue.

FAQs

FAQ 1: Is investing in gold a good hedge against inflation? Answer: Yes, historically, gold has been considered a good hedge against inflation. When inflation rises, the value of currencies tends to decline, while the value of gold typically increases, preserving purchasing power.

FAQ 2: Can I invest in gold through my retirement accounts? Answer: Yes, it is possible to invest in gold through certain retirement accounts, such as self-directed Individual Retirement Accounts (IRAs). These accounts offer the flexibility to include physical gold or gold ETFs as part of the investment portfolio.

FAQ 3: Are there any tax implications when investing in gold? Answer: Tax regulations regarding gold investments may vary depending on your jurisdiction. It is advisable to consult with a tax professional or financial advisor to understand the specific tax implications related to investing in gold.

FAQ 4: What is the minimum investment required to invest in gold? Answer: The minimum investment required to invest in gold can vary depending on the investment avenue chosen. Some options, such as gold ETFs, may allow for smaller initial investments, while purchasing physical gold may require larger sums.

FAQ 5: Can I buy and sell gold quickly? Answer: The ease of buying and selling gold depends on the chosen investment method. Gold ETFs and some online platforms provide liquidity and allow for quick transactions. However, selling physical gold may require more time and effort.

Conclusion:

Investing in gold offers individuals a way to diversify their portfolios, preserve wealth, and potentially hedge against economic uncertainties. Whether through physical gold or gold ETFs, understanding the different investment options, assessing risk tolerance, and conducting thorough research are essential steps in making informed investment decisions. By incorporating gold into your investment strategy, you can navigate the ever-changing financial landscape with confidence.