nvesting in gold has long been considered a reliable and valuable asset for individuals seeking to diversify their investment portfolio. Gold offers a hedge against inflation, serves as a safe haven during economic uncertainties, and has a history of retaining its value over time. If you’re interested in exploring the world of gold investment, this comprehensive guide will provide you with valuable insights, strategies, and options to get started.

Why Invest in Gold? Understanding the Benefits

The Advantages of Investing in Gold

Investing in gold offers several key benefits that make it an attractive option for investors. Gold acts as a risk diversifier within an investment portfolio, often showing low or negative correlation with other assets such as stocks and bonds. This characteristic helps reduce overall losses during market downturns, making it a valuable risk management tool.

Hedging Against Inflation and Economic Uncertainties

Gold has historically served as a hedge against inflation, which erodes the purchasing power of fiat currencies. During periods of economic uncertainties, such as geopolitical tensions or financial crises, gold tends to retain its value or even experience price appreciation. This makes it a reliable store of wealth and a safe haven investment.

Preservation of Wealth and Long-Term Value

One of the primary advantages of investing in gold is its ability to preserve wealth over the long term. Unlike paper currencies that can be subject to depreciation, gold has maintained its value throughout history. It provides a tangible and universally recognized form of wealth that can withstand economic fluctuations and serve as a reliable asset for future generations.

Different Ways to Invest in Gold

Exploring Various Investment Options

When it comes to investing in gold, there are several options available to suit different investor preferences and financial goals. Here are some of the most common ways to invest in gold:

Physical Gold: Bars, Coins, and Jewelry

One traditional method of investing in gold is by purchasing physical gold in the form of bars, coins, or jewelry. These tangible assets offer direct ownership of gold and can be easily stored or held personally. However, it’s important to consider factors like storage costs, security, and potential resale value when opting for physical gold.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs provide investors with an opportunity to gain exposure to the price of gold without physically owning the metal. These funds typically hold gold bullion as their underlying asset and are traded on stock exchanges. Gold ETFs offer liquidity, ease of trading, and the ability to invest with smaller amounts compared to physical gold.

Gold Mining Stocks

Investing in gold mining companies is another way to indirectly participate in the gold market. When investing in mining stocks, investors gain exposure to the potential profitability and growth of these companies. However, it’s essential to carefully research and analyze the financial health and performance of mining companies before making investment decisions.

Gold Futures and Options

For sophisticated investors with knowledge of derivative markets, gold futures and options provide opportunities for trading and speculating on the price of gold. These financial instruments require careful consideration of market dynamics and can involve higher levels of risk compared to other investment options.

Investing in Gold in Singapore: Special Considerations

Gold Investment Options in Singapore

In Singapore, there are specific investment options and platforms tailored to cater to the needs of local investors. Here are a few notable options to consider:

Gold Vault and Micro-Investing Platforms

The Hugo Gold Vault is an innovative platform that allows investors to buy gold with minimal amounts, starting from as little as S$0.01. This platform charges a nominal fee of 0.5% per transaction, making it accessible to a wide range of investors.

Gold ETFs on the SGX

The SPDR Gold Shares ETF is a popular choice for retail investors in Singapore. It trades on the Singapore Exchange (SGX) and can be purchased through various brokerages. Notably, this ETF is one of the few that allows CPF funds to be used for investment.

Robot-Advisors and Managed Portfolios

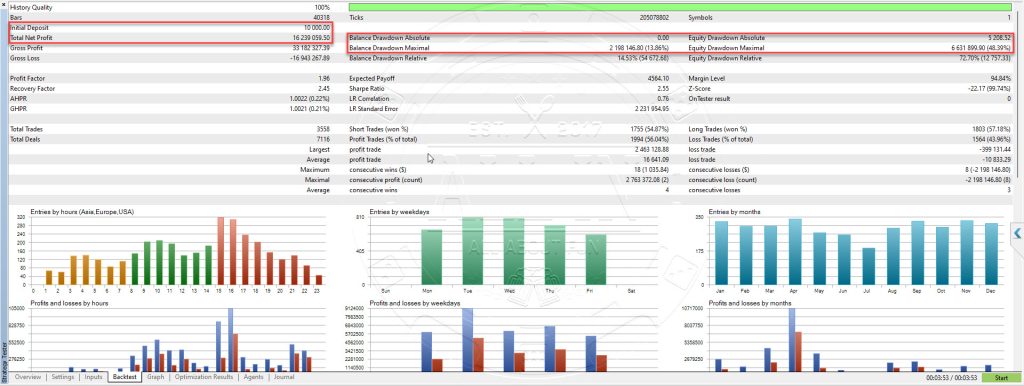

Robot-advisors have gained popularity among retail investors in recent years, offering a convenient and automated way to invest in gold. By selecting a robot-advisor with a diversified investment strategy that includes gold allocations, investors can gain exposure to gold within a managed portfolio. Kintech Gold EA is one of the best Expert Adsior (Robot) for auto trading with Gold.

Strategies for Successful Gold Investment

Key Considerations for Gold Investment

Investing in gold requires careful planning and consideration. Here are some essential strategies to keep in mind for successful gold investment:

Define Your Investment Goals and Risk Tolerance

Before investing in gold, it’s crucial to clearly define your investment goals and assess your risk tolerance. Determine whether you’re seeking long-term wealth preservation, capital appreciation, or short-term trading opportunities. Understanding your risk appetite will help you select the most suitable investment options.

Conduct Thorough Research and Analysis

Whether you’re investing in physical gold, gold ETFs, or mining stocks, conducting thorough research is paramount. Analyze historical price trends, assess the financial health of companies or funds, and stay updated with market news and developments. This knowledge will empower you to make informed investment decisions.

Diversify Your Portfolio

Diversification is a fundamental principle of successful investing. Consider including gold as part of a well-diversified portfolio that includes a mix of asset classes, such as stocks, bonds, and real estate. This approach helps spread risk and enhances the stability and potential returns of your overall investment portfolio.

Conclusion

Investing in gold offers a range of benefits, including diversification, inflation hedging, wealth preservation, and long-term value. By exploring various investment options like physical gold, gold ETFs, mining stocks, and derivative instruments, investors can tailor their strategies to meet their financial goals. In Singapore, specialized platforms and investment options make it easier for individuals to access the gold market. However, it’s essential to approach gold investment with careful planning, research, and a well-defined investment strategy to maximize potential returns and mitigate risks.